Whether you’re a seasoned investor or just getting started, you’ve probably come across the term “decentralized finance” while reading up on the blockchain or new coins. The bitcoin movement is predicated on a technology known as decentralized finance (DeFi). Despite its importance in that field, its applications could be much broader.

The elimination of middlemen, such as banks, from financial dealings is another selling point for DeFi. This can increase the market for some financial products but also increase the danger associated with DEF trades. If you’re interested in decentralized finance but want to master the fundamentals first, here they are.

The term “decentralized finance” is used to describe alternative financial institutions and platforms that don’t rely on the central banking system. The most widely used method of DFI currently makes use of blockchain, the distributed ledger technology that underpins the vast majority of today’s most prominent cryptocurrencies.

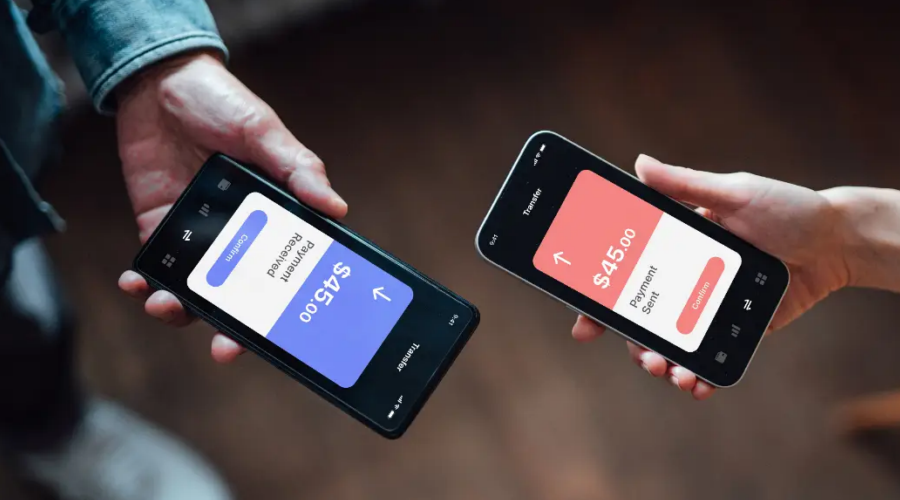

DeFi-type technologies include Bitcoin. No central authority, not even a bank, oversees Bitcoin transactions. Instead, it is peer-to-peer, allowing anybody to participate in the process of creating, verifying, and reviewing transactional entries, as well as storing the broader database itself.

DeFi is expanded upon by the Ethereum network. Ethereum creates a landscape for a variety of tokens, rather than just one. Its blockchain may run code created by programmers without stifling the network’s decentralized character.

But DeFi isn’t limited to the crypto or blockchain world by any means. Instead, it might be used to represent any kind of monetary transaction that doesn’t require the use of conventional payment processors or banks.

DeFi groups practice a form of direct democracy in their operations. This implies that there cannot be a single party in control of the associated application or cryptocurrency. Instead, the community gains sway as the project matures and more users become involved.

Possession of native tokens is typically a prerequisite for participation privileges. Token holders have voting rights when it comes to shaping the direction of a project. What this entails exactly is up to the specifics of the app, cryptocurrency, and any other restrictions governing the undertaking.

However, there is a lack of conventional banking protocols and monitoring in all DeFi ventures. P2P transactions are more common and generally rely on peer-to-peer verification to assure legitimacy. This means that no single party or person has the authority to decide whether a certain transaction or set of rules is legitimate. Instead, the voice of the majority is always taken into account.

In a broad sense, cryptocurrency is a decentralized endeavor. The system was built such that conventional banks are unnecessary. Additionally, no one company decides the future of any given token; rather, everyone who uses cryptocurrency has a say in its development. However, the use of DeFi ideas is not limited to the realm of cryptocurrencies.

Another type of initiative with a focus on DeFi is the decentralized autonomous organization (DAO). There are already around 4,000 of these online organizations, all working to unite people in favor of a shared cause. Their goals may be different, but they all use DAO-specific currencies and promote flat hierarchical systems.

Another byproduct of this movement is the emergence of DeFi exchanges (DEXs). These are designed to facilitate the trade of cryptocurrencies and NFTs between peers. They accomplish this by removing the need for consumers to deal with the intermediary exchanges typical of conventional brokerages or any cryptocurrency exchange that restricts user access to a single wallet. Furthermore, many transaction fees are reduced or eliminated.

There are many obstacles to overcome in DEFI projects, despite the fact that decentralized finance has a lot to offer in terms of long-term viability and practical potential. An advantage from one point of view can be a disadvantage from another. The benefits and drawbacks of DEFI are discussed below.

DeFi’s resistance to eradication, censorship, and elimination is one of its primary strengths. It is quite difficult to completely disable a computer network. It’s also not very likely that all linked assets will be confiscated.

The decentralized peer-to-peer model reduces physical constraints and financial costs. In contrast to centralized systems, users of decentralized systems can conduct worldwide transactions with the same ease as local ones.

Some financial services may be more accessible with DEFI as well. DeFi typically does not use common identification methods or standard measures of financial responsibility. Because of this, DeFi projects can provide individuals with access to resources that would be inaccessible via conventional banking channels.

Smart contracts are one such related technology that can streamline the agreement or transaction process. And because they can’t be changed, you may rest assured that your data is safe with them.

One disadvantage is that DeFi often requires a lot of processing power to function properly. Mining is the process of solving complex equations used to verify transactions.

Bitcoin mining uses about 91 terawatt-hours of electricity annually on average. That’s more than the whole year’s consumption of Finland, a country of around 5.5 million people. That’s just for one cryptocurrency; added together, they might have a significant impact on global warming.

Fewer protections exist when there is no single authority to rely on. The responsibility for the safety of one’s possessions often rests squarely on the shoulders of the owner. If the private key to your cryptocurrency wallet is lost or stolen, you will likely never see your funds again.

Even though smart contracts improve security, they are not without their flaws. The availability of the source code makes it vulnerable to being used as a hacking tool. The sheer quantity of code also poses challenges, especially when trying to keep track of errors.

Finally, while there aren’t many rules in place right now, that’s likely to change soon. Therefore, the DeFi ecosystem of today is unlikely to look like the DeFi environment of the future; future legislation may render certain tactics unfeasible or, at the very least, illegal.